how are rsus taxed in canada

Taxable amount is fair market value of the shares on the tax event. Of shares vesting x price of.

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

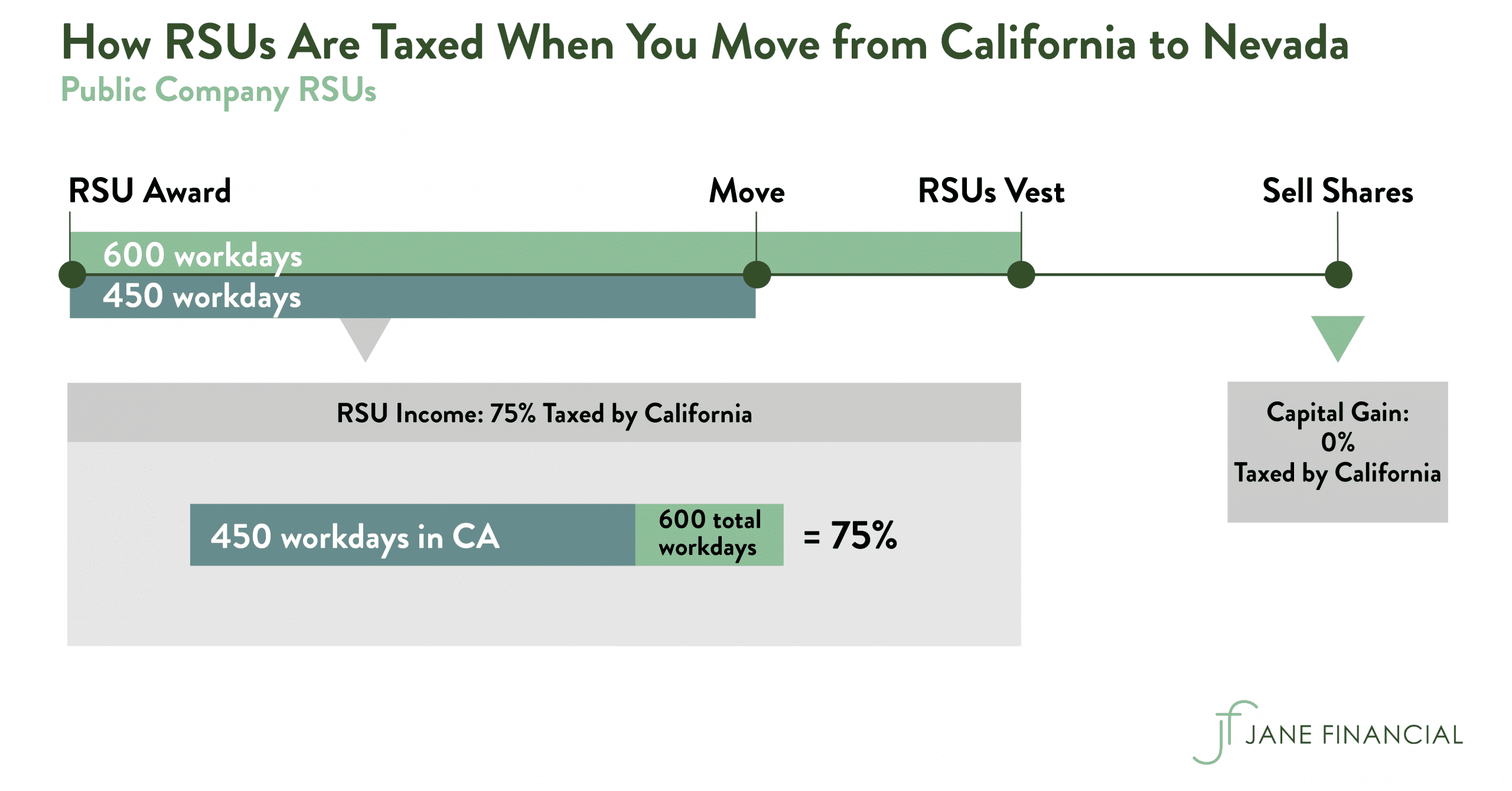

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

. Here is how RSUs are taxed. However you should be aware that this amount is already included in Box 1 as wages. Your RSU income is taxed only when you become fully vested in your shares.

RSUs are taxed as income to you when they vest. 613-751-6674 Chantal Baril Tel. You have compensation income.

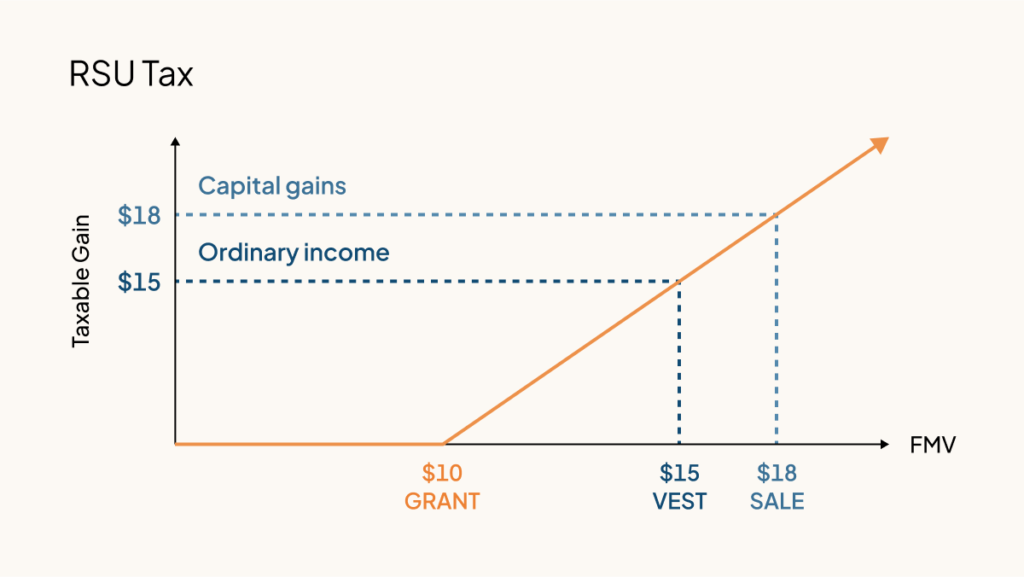

With RSUs you are taxed when the shares are delivered which is almost always at vesting. The units represent a. You pay full income tax on the value on.

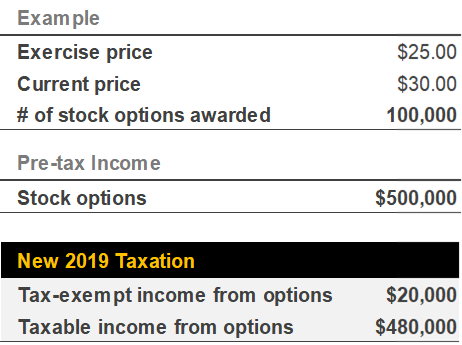

We can assess whether it is required and help you become. Other 1000 CAD is actually what I gained during 1 year and this is going to be taxed as a capital gain tax. Those plans generally have tax consequences at the date of exercise or sale whereas restricted stock usually becomes taxable upon the completion of the vesting schedule.

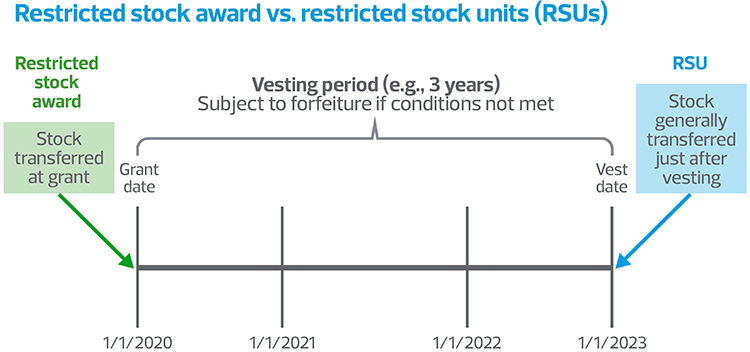

Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. When vested the price difference is taxed as capital gain which count as 50 income. An RSU has little or no value until the vesting restrictions conditions have been achieved.

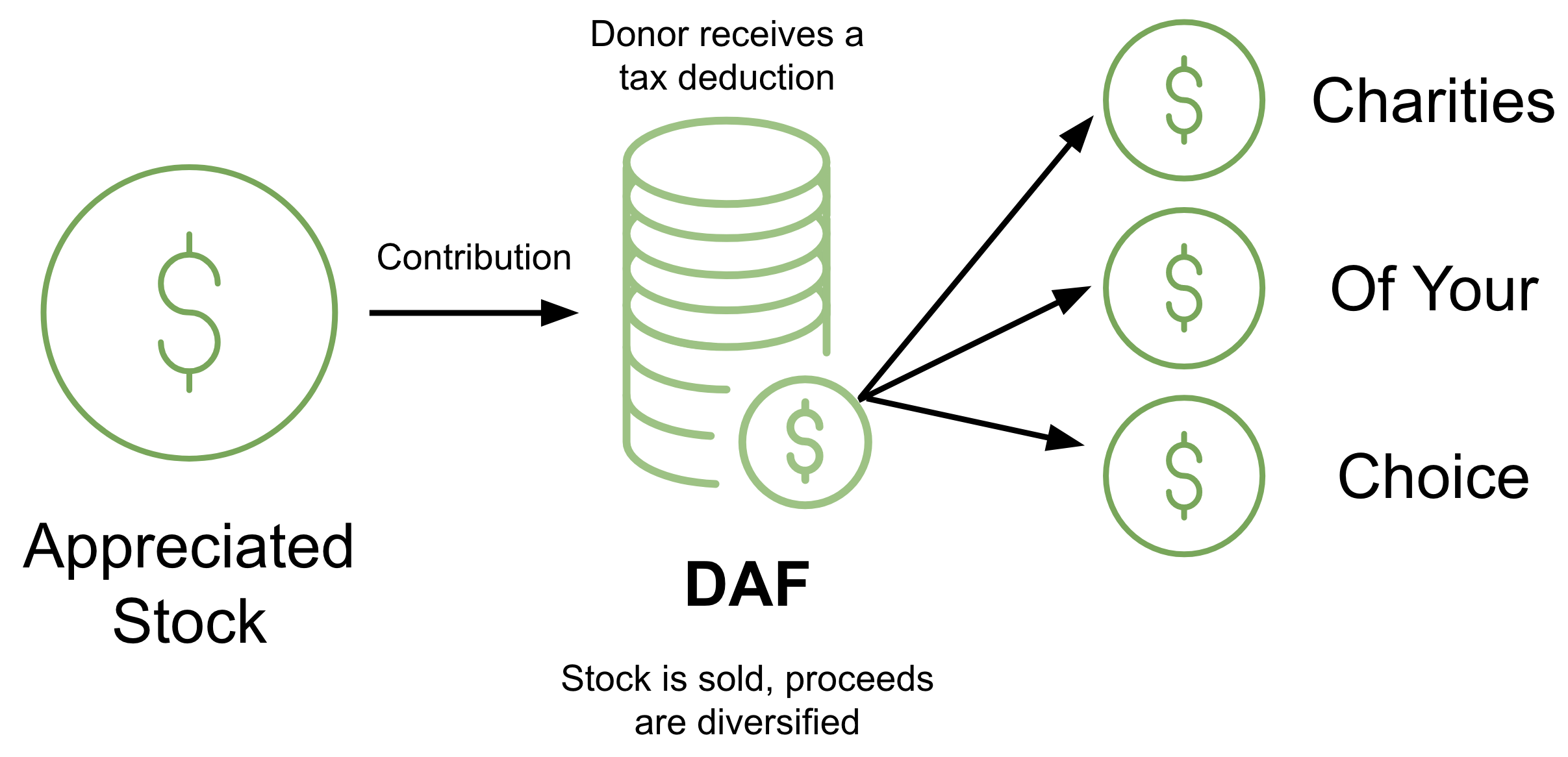

The RSU amount is. In Canada RSU plans are commonly referred to as phantom plans because under an RSU plan the employee initially receives notional units not shares. If you hold on to the stock for a day or more after vest.

The employee is taxable on the value of the stock upon issuance. Also restricted stock units are subject. You just pay full income tax on the value at vest.

Your taxable income is the market value of the shares at vesting. If RSUs are settled in cash or can be settled in cash or shares. RSUs are taxed just like if you received a cash bonus on the vesting date and used that money to buy your companys stock.

RSUs can trigger capital gains tax but only if the stock. If the stock is later forfeited no deduction is. Remember that an RSU is technically nothing more than a promise that.

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. If you sell your shares immediately there is no capital gain tax and you only pay ordinary income. We can calculate the taxable benefit and assess whether a deduction equal to 50 of the benefit is available.

So at the end Id end up getting. These awards can have adverse tax consequence and are rarely used. If you live in a state where you need to pay state.

When is RSU income taxed. At the time the RSUs vest the employee is typically provided with shares and a. The amount that is reported in Box 14 on Form W-2 is the RSU amount.

Tax at vesting date is. When granted RSU is taxed as income. For example your marginal tax rate is 30 you got.

If you sell your RSUs on vest date. Generally tax at vesting for RSU. 1000 07 1000 05 700 500 1200 CAD.

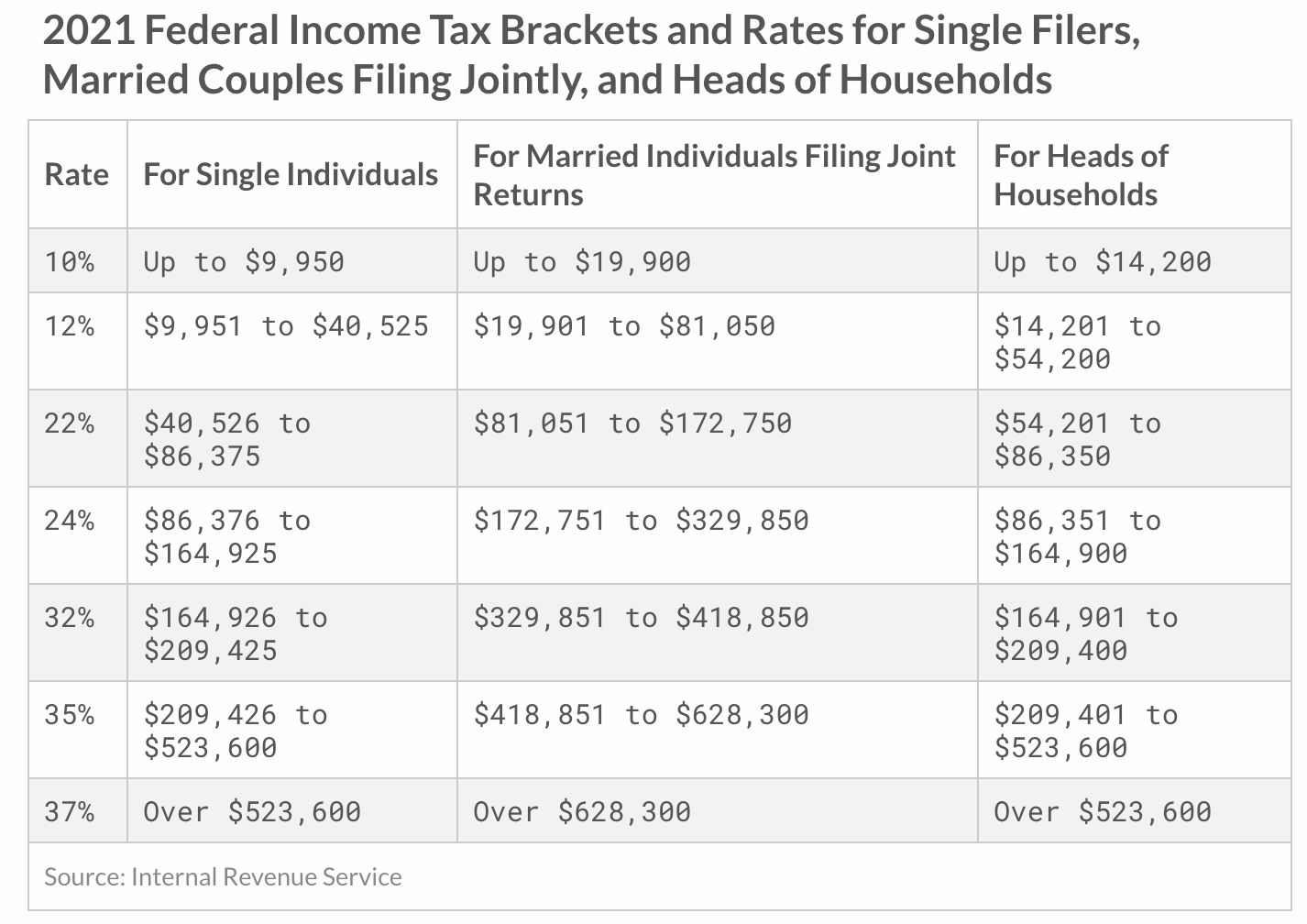

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

Taxation Of Stock Options For Employees In Canada Madan Ca

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsus Vesting In Spring Best Tax Strategy R Personalfinancecanada

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

How To Handle Taxes On Company Stock Kiplinger

How To Avoid Taxes On Rsus Equity Ftw

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsa Vs Rsu What S The Difference Carta

Restricted Stock Units Jane Financial

How Are Rsus Taxed In California Quora

Frequently Asked Questions About Restricted Stock Units

Restricted Stock Units Jane Financial

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor